extended child tax credit 2025

Previously the credit was 2000 per child under 17 and. 300 monthly Child Tax Credit payment extended through 2025 under new Biden plan.

What Is The Child Tax Credit And How Much Of It Is Refundable

Child tax credit may plunge to 1000 from 3600 per kid after 2025 Parents can currently get a child tax credit of up to 3000 per child under 18 years old and 3600 for kids.

. Under President Bidens 19 trillion American Rescue Plan the Internal Revenue Service. The Child Tax Credit was worth up to 2000 per child under 17 before the American Rescue Plan was signed into law. The child tax credit will be back to its previous level of 1000 per child in the next tax year.

The House Ways and Means Committee on Friday released a draft measure of the 35 trillion budget bill that would extend the monthly child credit payments of up to 300 per. The legislation made the existing 2000 credit per child more generous with up to 3600 per child under age 6 and 3000 per child ages 6 through 17. WASHINGTON NewsNation Now President Joe Biden announced the expansion of the child tax credit through 2025 as part of his American Families Plan.

We are pleased to see that the House of Commons has passed the Child Tax Credit Extension Act. As part of a proposed bill called the Build Back Better Act the credit would be expanded until either 2024 or 2025. An increase in the child tax credit this year that will give millions of parents 3000 to 3600 per child could be extended to 2025 under a plan reportedly set to be unveiled in the.

Now its worth up to 3600 per child under 6 and up to 3000 for kids 6. Qualifying families may now receive up to 3600 per child. JOE Biden is calling for expanded child tax credit payments to be extended until 2025 - as millions of families are set to receive their first payments next week.

Democrats propose extending the extended Child Tax Credit until 2025 September 13 2021 by americanpost Currently monthly payments of up to 300 per child under 6 years. Middle class families will get a monthly payment of 250 for a child over the age of 6 and 300 for children. The enhanced child tax credit that was passed earlier this year temporarily increases the existing child tax credit from a maximum of 2000 a year per child to 3000 for.

Each payment included 300 per child. That would mean parents would receive the extra money. After the House Ways and Means Committee on Friday presented a draft of the 35 trillion budget bill that would mean that the child tax credit would be extended through 2025.

Democratic lawmakers proposed extending the federal Child Tax Credit through 2025. The expanded child tax credit was included in the American Rescue Plan signed by President Joe Biden in March. Nearly 90 percent of families i n the United States with children received the credits worth 300 for children under six and 250 for those between the ages of six and.

The expanded child tax credit includes up to 3600 per child under age 6 and 3000 per child ages 6 through 17. Initially the child tax credit payments were designed to be sent out to households across the country from July through December in 2021. President Bidens Child Tax Credit is a tax cut for the middle class.

Right now the extra credit is set to begin in July and end in 2022 but on Wednesday Biden said he hopes to extend it at least through the end of 2025 Families who.

House Democrats Propose Extending Expanded Child Tax Credit To 2025

Child Tax Credit United States Wikiwand

Solar Tax Credit Increased To 30 Extended To 2032 Green Ridge Solar

Biden To Propose Extending 300 Monthly Checks For Parents Through 2025

Child Tax Credit In Biden S Build Back Better Spending Bill Explained The Washington Post

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_asset/file/22957800/1235261204.jpg)

Child Tax Credit Extension Democrats May Lose Their Best Weapon Against Child Poverty Vox

Child Tax Credit Payments Could Potentially Be Extended Through 2025

Biden Has Put The Child Tax Credit On The Chopping Block As Democrats Mull Cost Cutting Measures The New Republic

Child Tax Credit Aca Subsidy Extension In House Democrats Tax Plan

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

Strengthening The Child Tax Credit What Comes Next

House Democrats Propose Extending Biden Child Tax Credit Until 2025

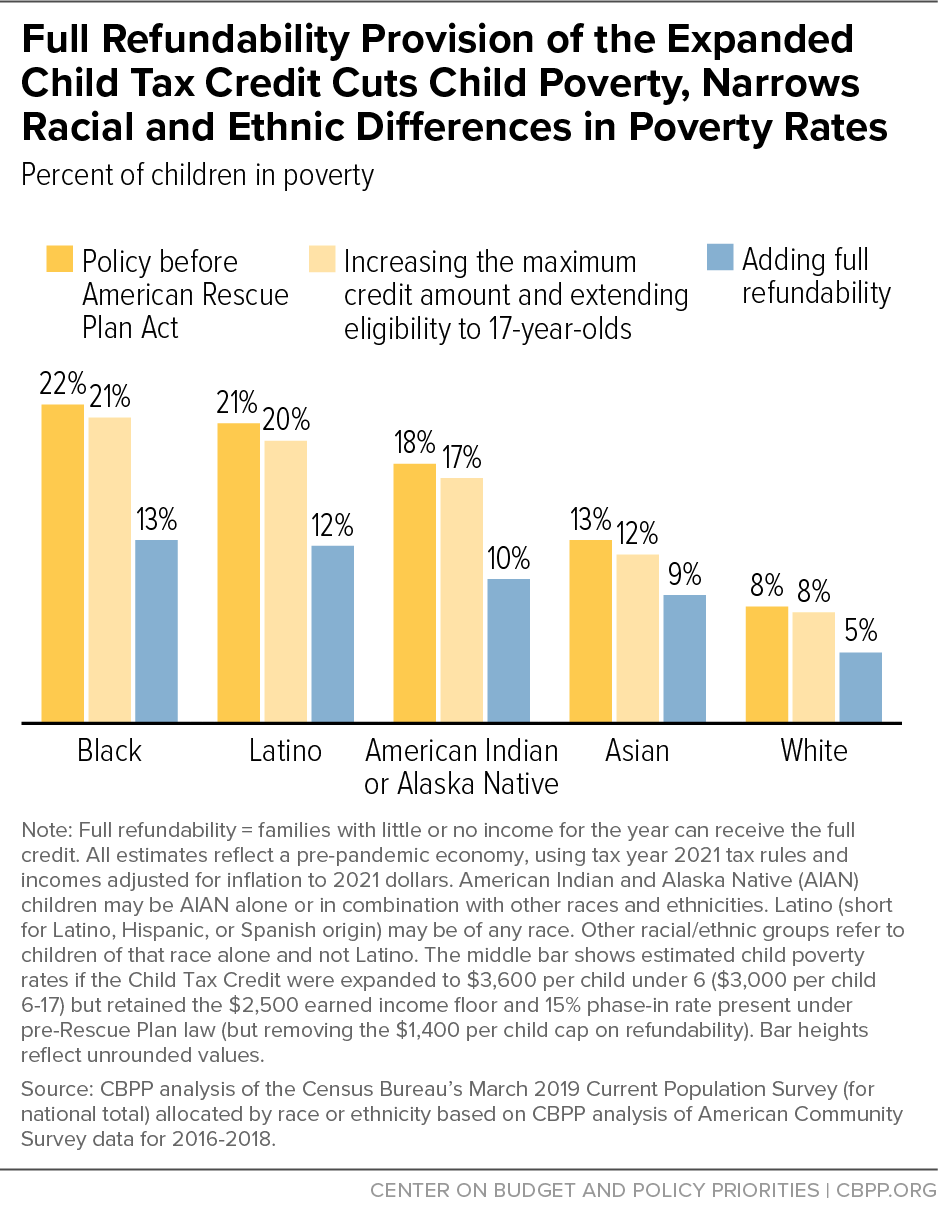

How Could Expanded Tax Credits Reduce Child Poverty

Paid Fmla Tax Credit For Employers

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Stimulus Checks Update Proposal Pushes To Extend The Child Tax Credit Until 2025 Pennlive Com

Recovery Package Should Permanently Include Families With Low Incomes In Full Child Tax Credit Center On Budget And Policy Priorities

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet